ETH: up to 12% APY

Are you looking to maximize the earning potential of your Ethereum (ETH) investments? Look no further than EarnPark, a reliable and SEC-compliant UK-based crypto investment platform available in over 180 countries.

Best ETH Interest Rates & Staking APY

Looking for the best passive income from ETH? While traditional Ethereum staking typically offers low yields, EarnPark uses advanced DeFi and CeFi tools to deliver up to 12% annual returns — far higher than typical staking or savings alternatives.EarnPark’s yield strategy is built around:

- Concentrated liquidity provision on decentralized exchanges (DEXs)

- Market-making algorithms on CEXs and DEXs

- Risk-hedged lending models

- Compound interest optimization with daily payouts

How the ETH strategies worksEarnPark’s ETH strategies utilizes your deposited ETH in high-yield, real-time DeFi protocols and Algo Trend:

Deposit- DeFi DEXs: Earn from trading fees and price movement spreads

- Lending pools: Provide liquidity to trusted borrowers

- Hedging techniques: Reduce risk through smart balancing across multiple platforms

EarnPark vs Ethereum staking – which is more profitable?

Unlike static staking platforms, EarnPark dynamically allocates your Ethereum into the most profitable, risk-adjusted DeFi opportunities, delivering consistent gains with built-in security.

| Feature | Ethereum (ETH) Staking | EarnPark Strategy |

|---|---|---|

| Average APY | 3–8% | Up to 12% |

| Payout Frequency | Weekly or Monthly | Daily / Monthly |

| Compounding | Rare | Yes |

| Risk Strategy | None | Hedged |

| Platform Type | Single protocol | Multi-platform |

How to Start Earning in 4 stepsHow to Start Earning

in 4 steps

in 4 steps

1.

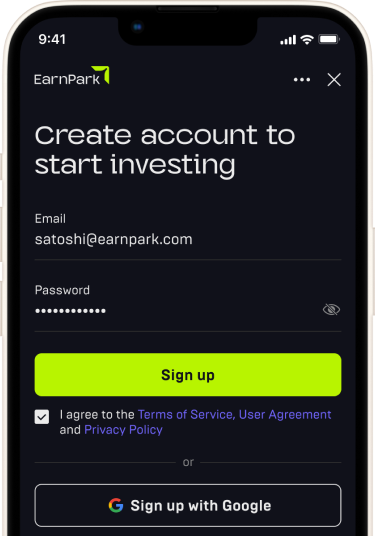

Create your EarnPark account

Use your Gmail to start and get going in less than a minute.

1.

Create your EarnPark account

Use your Gmail to start and get going in less than a minute.

1.

Create your EarnPark account

Use your Gmail to start and get going in less than a minute.

2.

Create your deposit address and add coins

3.

Start earning instantly

Your yield is automatically paid to your EarnPark account, and the next day you’ll earn interest on top of it. This way, your daily payouts get bigger over time.

4.

Withdraw funds any time

Is EarnPark safe for Ethereum (ETH) investments?Yes. EarnPark is a SEC-compliant, UK-based crypto interest platform trusted by over 100,000 investors across 180+ countries. We use:

- Smart contract audits

- Multi-layered wallet security

- CeFi and DeFi integration

- Real-time portfolio balancing

- Transparent strategy reporting

Trusted by 100,000+ crypto investorsOver $20 billion in crypto yield projections are simulated using the EarnPark calculator every month. Whether you're a beginner or experienced investor, EarnPark helps you maximize passive income with your Tether holdings — without complicated setup or hidden fees.

UK-Based

Global & SEC-compliant (180+ countries)

Market Maker

We are Qualified market makers on Binance

Proof of Reserves

Regular reports ensuring your assets are secured

Frequently Asked Questions

What is compound interest in crypto?

Compound interest allows your earnings to grow exponentially by reinvesting the interest earned on your crypto deposits.

How does compound interest work with EarnPark?

In EarnPark, compound interest is calculated by adding the interest earned to the principal amount, then earning interest on the new total. This method, especially with daily payouts, increases the interest earned over time as the principal grows.

How can I calculate compound interest in crypto using EarnPark Calculator?

To calculate compound interest on your crypto investments, use the EarnPark Calculator. Input your initial investment, interest rate, and compounding period to estimate your earnings over time.

Why is understanding compound interest, APR, and APY important in crypto investing?

Understanding these concepts is crucial for making informed investment decisions in crypto. They help investors grasp how their wealth can grow over time and the returns they might expect from their investments.

What does APY mean in crypto investments?

APY, or Annual Percentage Yield, measures the return on an investment considering the effects of compounding interest. It provides a more accurate return estimate, especially for long-term investments.

How is APY calculated in crypto using the EarnPark Calculator?

To calculate APY, use the EarnPark calculator. Select an asset and return strategy, determine the compounding period, and enter the initial investment. The calculator provides an estimate of income over time, reflecting the effect of compounding.

How can I calculate passive income for crypto wealth using EarnPark?

Use the EarnPark Calculator to estimate the passive income from your crypto investments. The calculator factors in compound interest, helping you understand potential earnings and wealth accumulation over time.

What is APR in the context of crypto?

APR, or Annual Percentage Rate, in crypto refers to the annual interest rate earned on an investment or paid on a loan. It's a straightforward measure of the interest rate over a year.

What should I keep in mind when using the EarnPark Calculator for crypto investments?

Remember that investing in crypto carries risks, and it's important to do your own research. The EarnPark Calculator provides estimates for informational purposes and should be used as a guide for potential earnings, not a guarantee.

How is APY different from APR in crypto?

APR is the basic annual rate, while APY includes compounding. APY gives a more accurate picture of your real returns.

Is it free to use the EarnPark Calculator?

Yes – no signup needed, and you can explore potential returns instantly.

How do I calculate my passive income in crypto?

Use EarnPark’s free calculator to simulate your earnings based on your deposit amount, interest rate, and compounding frequency.